What Makes Payment Reminders Valuable

When dealing with a customer who has missed a payment, it’s important to maintain a professional image. Harassing someone who has missed a payment not only shines a negative light on you and your business, but it’s unlikely to get anyone to pay their balance.

While it’s frustrating when a customer hasn’t paid (especially for a small business), maintaining a cool composure and not coming off as pushy will benefit you in the long run.

So, here are five templates you can use to request an outstanding payment without sounding pushy:

One-Week Overdue Reminder Template:

Hi, [Client Name]!

This is [Associate Name] with [Company Name].

Payment for Invoice [#] of [invoice amount] is one week overdue.

You can make your payment here: [Link to payment].

If there is anything we can do to assist you in getting this settled, please reach out!

Thank you for your time.

[first name]

One Day Overdue Reminder Template:

Hello [Client Name],

This is [Associate Name] with [Company Name].

According to our records, Invoice [#] is overdue as of yesterday. Currently, there is a balance due of [amount].

I’ve attached the invoice and payment options here [insert invoice link].

If you have any questions or concerns, please reach out to us.

Thank you for your time.

[First name]

Two Weeks Overdue Reminder Template:

Hello, [Name of Client]!

This is [Associate Name] with [Company Name].

I wanted to get in touch with you since my records indicate that the payment of invoice [#] is two weeks overdue.

For your convenience, I’ve included the invoice and payment option here: [link]. Please let me know if there is anything else we can do to help you. A status update would be really appreciated after the payment is made.

Please keep in mind that late penalties will be imposed on any payments that are more than 30 days overdue.

Please don’t hesitate to contact us if you have any questions.

Thank you.

[enter the first name here].

One Month Overdue Reminder Template:

Hello, [Name of Client]

This is [Associate Name] with [Company Name].

We are reaching out to remind you that your payment on invoice [#] is now 30 days overdue as of [Date].

I’ve attached the invoice here [insert link] to make the payment process easy and hassle-free.

Please reach out to us if you have any questions regarding making a payment.

Thank you,

[First Name]

Additional Tips for Putting Together Payment Reminders

• Never sound threatening

• Offer an easy way to pay within your reminder by sending the client a link

• Always offer assistance by inviting clients to reach out to get any questions they may have answered.

• Don’t mention consequences

• Don’t reach out more than once per week. Any more frequent than this is too pushy/ aggressive.

Share Your Message with an SMS Campaign Today!

We make it fast, easy, and affordable to send compliant SMS, Email, and Voice campaigns.

AI-Powered Personalization: The Secret to Skyrocketing Email Engagement

Email marketing continues to play a pivotal role as a vital tool for businesses seeking to establish and maintain connections with their target audience within the dynamic landscape of our fast-paced digital world. Despite its enduring significance, the challenge of capturing attention within cluttered inboxes remains a persistent hurdle for marketers. In response to this ongoing challenge, the integration of AI-powered personalization has emerged as a crucial strategy to revolutionize and optimize email engagement.

AI and the Customer Experience: A Two-Headed Approach

Unlock the future of customer engagement with our latest blog post on the symbiotic relationship between AI and the customer experience. Dive into the dual forces of personalized interactions and AI-driven support, as we unravel how businesses are reshaping their strategies to cater to individual preferences and provide seamless assistance. Stay ahead in the dynamic market by understanding the strategic imperative of this two-headed approach. Read now for a glimpse into the evolution of customer experiences in the age of Artificial Intelligence.

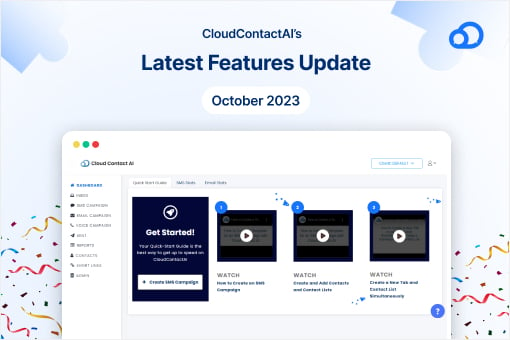

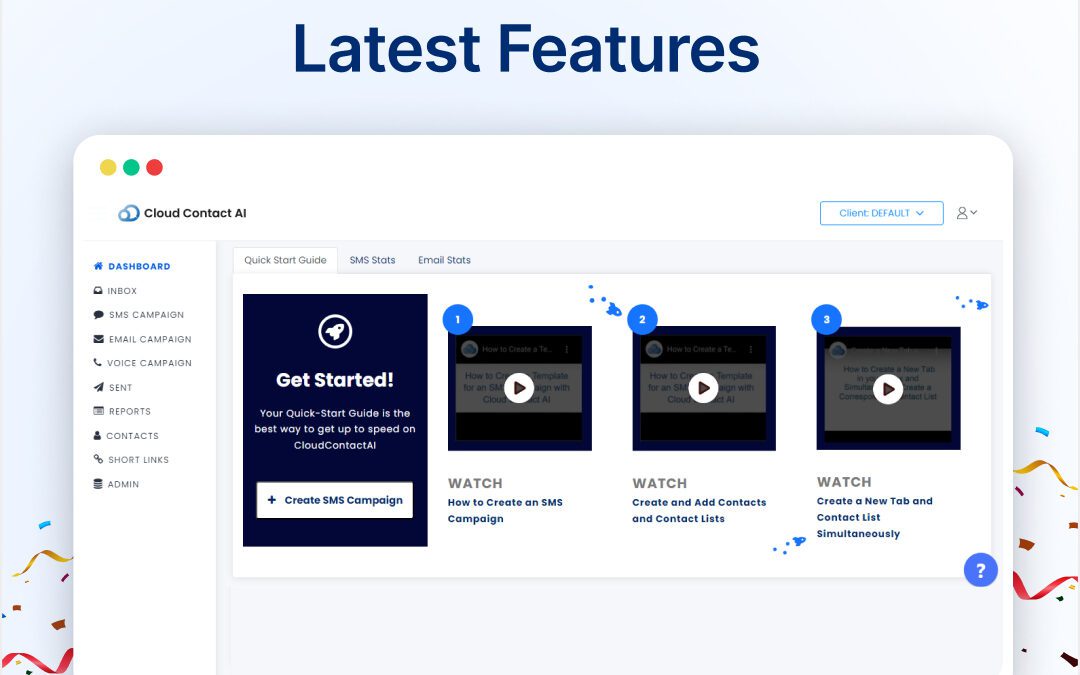

Our Latest Features: October 2023

Embracing the dynamic realm of contact management and customer engagement, CloudContactAI consistently stands at the forefront, revolutionizing the industry with innovative solutions. The recent wave of updates and feature enhancements introduced by CloudContactAI exemplifies our steadfast commitment to providing unrivaled service excellence. In the following blog post, we will embark on a comprehensive journey, delving into some of the most noteworthy improvements and exciting additions ushered in by our latest release.

Sports Event Management Using CloudContactAI

Event management can be stressful, time consuming, and difficult to get right. CloudContactAI is a cloud-based communication platform that can be used to manage a variety of sports events, including games, conferences, team practices, and award ceremonies. It offers a variety of features that can help event organizers to improve communication with attendees, volunteers, and staff.

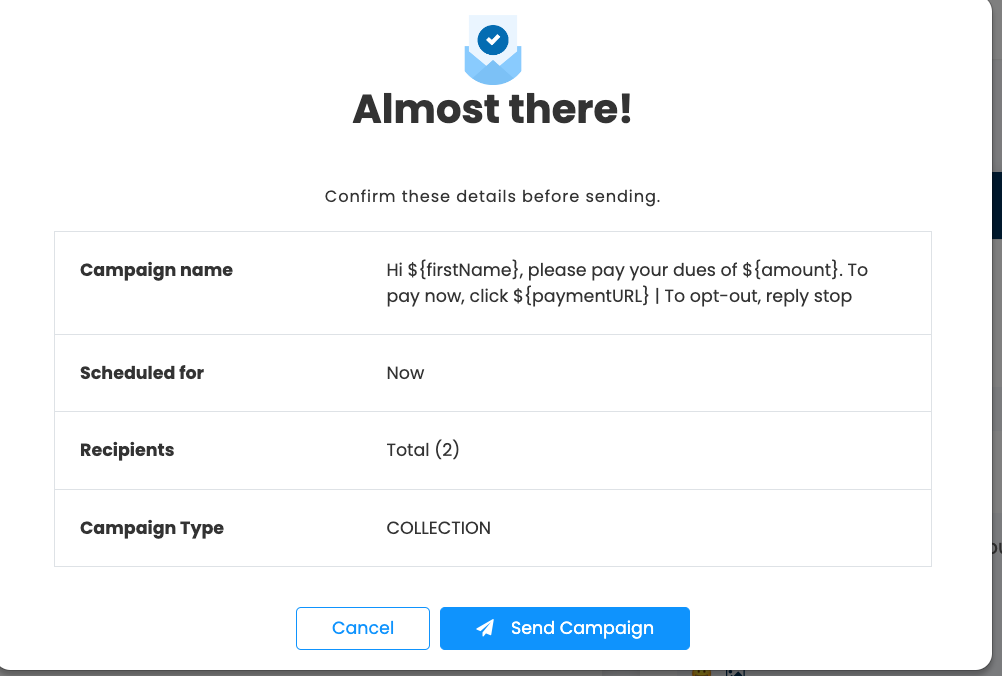

How to send out SMS Invoices with CloudContactAI

In this tutorial, we’ll show you how to send out SMS Invoices to people who owe you money. CloudContactAI makes it super easy.

Utilizing CloudContactAI to Get More Sign-Ups at Your Sports Facility

CloudContactAI is a cloud-based communication platform that can help sports facilities get more signups. It can send targeted messages, automate communication, and track results. CloudContactAI is easy to use, affordable, and effective. It can help sports facilities improve customer satisfaction, build relationships with customers, generate leads and sales, and save time and money.

What Sets Us Apart: CloudContactAI’s Latest Features

The world we live in is characterized by rapid technological advancement and ever-changing customer preferences. Stagnation can spell disaster for any business. An SMS platform is no exception. Regular updates aren’t merely about showcasing the latest trends; they’re about ensuring that the tools businesses depend on are finely tuned to address new challenges and opportunities.

Enhance Your Back-to-School Strategy with Texting for Schools

As summer vacations wind down, the thrill of back-to-school moments takes center stage. In this bustling time, harnessing the power of SMS for schools can be a game-changer. By seamlessly integrating SMS into your back-to-school strategy, you can effectively engage students, parents, and educators like never before.

How to Utilize SMS Marketing for Event Planning

Are you looking for a way to revolutionize your event planning? From scheduling automated campaigns to engaging attendees with real-time responses and targeted messaging, our platform brings event planning to the next level, ensuring seamless communication and unforgettable experiences for your attendees.