The Basics

SMS stands for Short Message Service. You probably know it as text messaging.

How do businesses enable SMS payments?

Businesses enable SMS payments by partnering with an SMS payment provider. These providers combine text messaging services with secure payment processing capabilities. Some SMS payment providers also function as credit card processors or facilitators, while others exclusively specialize in SMS payment processing. By integrating with an SMS payment provider, businesses can start accepting SMS payments and provide their customers with a convenient and contactless payment option.

What is SMS billing using payment links?

SMS billing using payment links is a straightforward method where a secure payment link is included in the message sent to the customer. The customer can simply click on the link provided, which will direct them to a secure online payment page where they can complete their payment.

What is SMS billing through SMS invoices?

SMS billing through SMS invoices is a more traditional method of taking payment. In this approach, the customer’s invoice is attached to a text message as an image in an MMS message or a PDF file. Additionally, a link is included in the message which directs the customer to a secure online payment platform where they can complete their payment.

What is SMS billing using text commands?

SMS billing using text commands is a method where businesses send a text message to the customer with a special keyword when they are ready to receive payment. The customer then replies with the keyword to send the payment amount through. This allows for a quick and simple transaction process through text messaging.

How can businesses set up SMS billing?

Businesses can set up SMS billing in one of three ways: text commands, SMS invoices, or payment links. Text commands involve sending a text message to the customer with a special keyword when payment is due, and the customer replies with the keyword to send the payment amount through. SMS invoices are a more traditional method where the customer’s invoice is attached to a text message as an image or PDF, and a payment link is included for them to complete the payment online. Payment links simply include a secure payment link in the message to allow customers to click on it and complete their payment.

How can SMS billing benefit businesses?

SMS billing offers many benefits for businesses, providing a streamlined and convenient method for customers to make payments. In today’s fast-paced world, customers no longer want to deal with complicated payment processes, and businesses strive to receive payments on time. This is where SMS billing can make a difference. By incorporating SMS billing into your payment system, you can enable customers to send payments quickly and easily through a simple text conversation.

This eliminates the need for back-and-forth emails or navigating complex websites, resulting in smoother and more efficient transactions. The growing popularity of mobile payment solutions highlights the significance of SMS billing. Customers increasingly prefer handling important tasks on their phones, and by facilitating payments within a text conversation, businesses can cater to this trend.

SMS payment reminders have a diverse range of applications across various industries. For instance, in the financial sector, banking institutions and insurers can utilize payment reminder texts to notify customers about upcoming credit card payments, ensuring they are aware of their financial obligations and prompting them to pay on time. In the healthcare industry, SMS reminders can be sent to patients to help them understand and settle their healthcare bills by providing payment estimates and clear payment instructions. Subscription-based services profit from implementing reminder texts to guarantee timely payments for their services, enhancing customer satisfaction and reducing late payments. Home service companies, such as cleaners or plumbers, can efficiently manage invoicing and payment processes through SMS reminders, especially in situations where workers may not have immediate access to computers.

Customers can complete transactions with just a few clicks, avoiding the hassle of traditional payment methods. This ease of use enhances the customer experience and increases the likelihood of timely payments. By leveraging the widespread use of mobile devices, SMS billing offers a valuable avenue for businesses to accept payments for their services.

How to Start Accepting SMS Payments

Your first and most crucial step to start offering SMS payments as an alternative payment method is to choose an SMS payment provider that is right for your business. Find out if your credit card facilitator offers SMS payment processing and compare the features and costs of other SMS payment providers.

SMS billing using text commands works by sending a text message to the customer containing a special keyword when it is time for payment. The customer then replies to the message with the keyword, triggering the payment process. This method allows customers to conveniently and securely set up their payment card in advance. Once the card is registered, the customer can easily authorize a payment by responding to the SMS message with the specified keyword. This approach ensures that the correct amount is charged each time a payment is due, providing a seamless and efficient billing experience for both businesses and customers.

After choosing an SMS payment provider, work with your company to choose the right plan based on your needs. Once that’s done, you can set up an invoice with your company, create an account, and get a third-party merchant account if needed. There are several praiseworthy business account services to choose from.

Link your customer database to your provider, create contact and contact time rules, and create basic text messages to send across multiple payment statuses.

Providers typically offer the option to receive payments using your current company phone number or virtual SMS number.

How can businesses set up SMS payments with CloudContactAI?

To start offering SMS payments as an alternative payment method, the first crucial step is to select the right SMS payment provider for your business. It is important to check if your credit card facilitator offers SMS payment processing and compare the features and costs of other SMS payment providers available. Once you have chosen an SMS payment provider, collaborate with your company to select the most suitable plan based on your specific needs.

After completing this initial step, you can proceed to set up an invoice with your company and create an account with the chosen provider. If required, you may also consider obtaining a third-party merchant account. Fortunately, there are several reputable business account services to choose from, ensuring you have options that align with your business requirements.

Next, it is essential to link your customer database to the selected SMS payment provider. This integration will allow for seamless communication and transaction processing. You can then proceed to establish contact and contact time rules to ensure effective and timely interactions with your customers.

To provide a smooth experience for your customers, it is important to create well-crafted text messages that convey necessary information across various payment statuses. These messages should be concise, clear, and informative, enabling your customers to easily understand the payment process and take appropriate action.

Most SMS payment providers offer the flexibility to receive payments using your existing company phone number or a virtual SMS number. This allows you to maintain consistency and ensures a hassle-free communication channel for your customers.

By following these steps and considering the thoroughness of the process described in Their article, you can successfully set up SMS payments with SimpleTexting. Remember, simplicity and convenience are key when integrating SMS payments into your business operations, and SimpleTexting proves to be a user-friendly platform for implementing this payment solution.

SMS Payment Solution

Intuitive interface: You should be able to customize the message content, response logic, and other settings. A simple interface allows you to control information and agility and make changes without paying a service fee.

Easy Transactions: If customers can store payment information for future payments, it will be more convenient for them and increase sales.

Backup System: Failure if payment is not made are backup communication options such as voice and email phone numbers.

Two-way SMS: This option allows you to set up an automatic SMS response triggered by the selected keyword to provide more information or give your customers the option to talk to agents.

High Quality Connections: High quality service provider connections help prevent text messages from arriving.

Dedicated Numbers: You must use unique phone numbers, not random or shared numbers. Dedicated numbers increase deliverability and customer confidence that phishing attempts are not targeting them.

Bulk Deposit: Transactions are credited in bulk, making it easy to check your books.

Affordable: Some SMS payment providers charge based on the number of individual SMS messages sent. Others pay for a series of text messages you send. Individual plans are probably the cheapest if customers tend to pay early when sending their first text message. If payment takes a long time, the chat or ticket method is more affordable. If you are sending a large number of paid SMS messages, the best option price is by volume or range.

SMS Services Grow Businesses

Ideally, you should start SMS payments before or after the sale. When you sell a service, you can instantly bill and receive payments via SMS while you’re with your customers, whether in a physical store, event, or wherever you are.

You can also use SMS to track other forms of communication, such as emails regarding the collection of expired invoices. Text messages are harder to ignore than other types of communication. Emails are easily buried in one’s inbox, but texts rarely go unopened. Also, since the message arrives on your mobile device, it’s more convenient to pay by phone than to write a check. If customers are easy to pay, they are more likely to pay on time.

If your business is already using SMS marketing services, adding SMS payment options can help you grow your sales. If you are already talking to a customer via SMS and the customer is interested in purchasing a particular product or service, you can send an SMS invoice for that product.

For more information about the SMS services we at Cloud Contact AI offer, visit our home page!

Email Campaigns going to Spam? Send Test Emails!

Sending emails is crucial to any marketing campaign. However, many business owners find that their emails end up in the spam folder. It’s crucial to test your campaigns beforehand to ensure that they’re getting delivered.

Stay Engaged with Hotel Guests via Text

Technology is evolving faster than ever, and so are guests expectations with travel. In this post, we dive into what guests are saying they look for in hotel stays, and how hotels can meet their demands with text messaging services.

Text Message Templates For Debt Collection

Sending payment reminders has never been easier. Cloud Contact AI’s easy-to-use text messaging platform helps you reach out to debtors and get paid faster. Let’s take a look at some text message templates you can use today!

How to Create a Template for an SMS Campaign with Cloud Contact AI

This quick but detailed video tutorial covers how to create a template for an SMS campaign using CCAI’s easy-to-use interface.

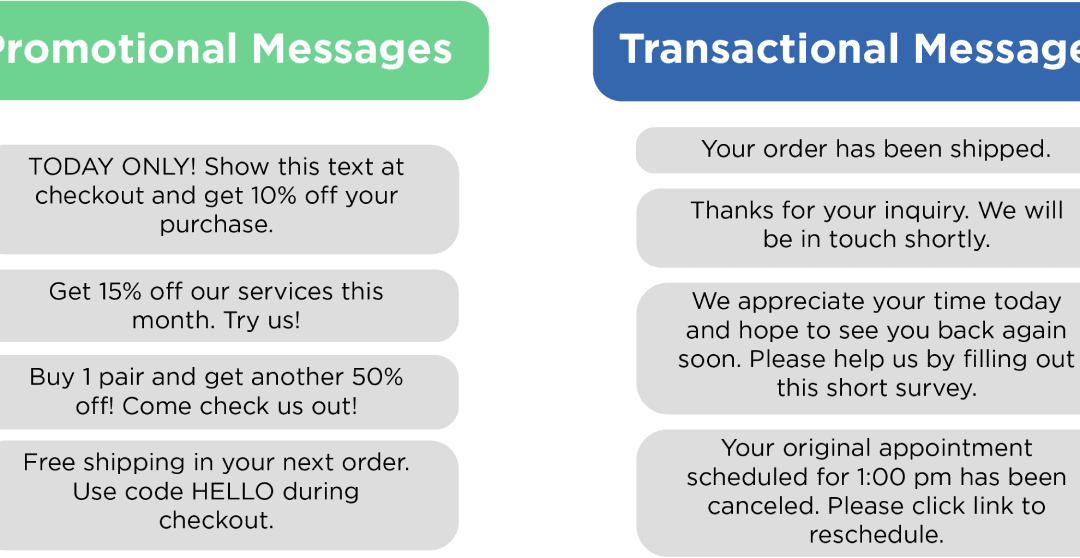

Transactional SMS

Having a direct pipeline to customers is important. People on average spend roughly 3.5 hours per day on a cellular device and prefer SMS as a means of communication, giving ample opportunity to reach out. Instead of reaching out for marketing, there are plenty of other reasons companies would want to reach out, whether it be verifying that a package has been sent, and other more. It’s currently the strongest means of establishing and maintaining a line of communication with customers.

Using SMS for a Product Launch

Launching a product is important to get right, primarily in regards to marketing. Show absolutely no marketing and the target market will fall under the impression that there was no faith on behalf of the producers that the product was ever going to show any potential to begin with. The general idea is to spread brand awareness while building confidence in the product or service so that when it’s finally put out to the market, it can draw some attention.

Basic SMS Marketing Tactics for the Beginner

While email marketing still remains popular, there is no doubt that SMS is taking over. Today we’ll dive into some distinct advantages that SMS has over email, and different tactics one can use when switching from an email marketing strategy.