Feb 12, 2026 | How to, lead generation, SMS, SMS Marketing, Text Messaging

Banks love SMS for its effectiveness. Regulators love SMS for its audit trail. What regulators don’t love: banks that text customers without proper consent, at inappropriate hours, or without required disclosures. The penalties for getting it wrong are severe—$500 to...

Feb 11, 2026 | Customer Service, Debt Collection, How to, SMS, Templates

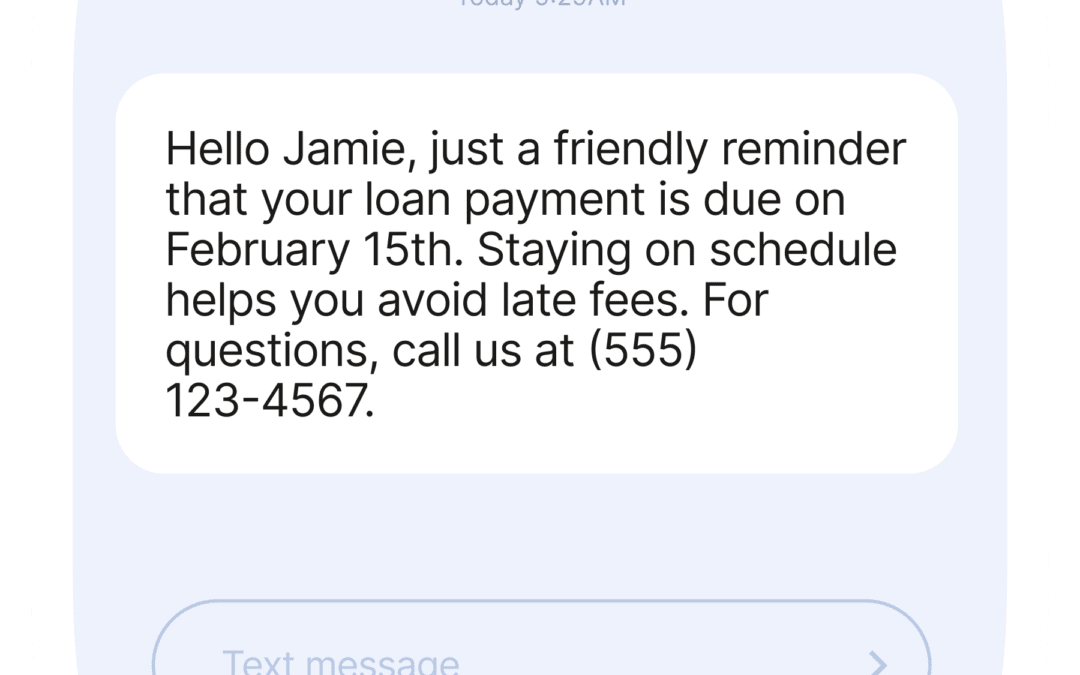

Your collections team is drowning. Every month, hundreds of accounts go past due. Each one needs attention—a reminder here, a follow-up there, an escalation when things get serious. Multiply that by the number of days past due, and you’ve got thousands of manual...

Feb 11, 2026 | SMS, SMS Marketing

Auto loan delinquency costs banks billions annually. The American Bankers Association reports that delinquency rates fluctuate between 2-4% depending on economic conditions—and every percentage point represents real money walking out the door. The frustrating part?...

Feb 11, 2026 | Debt Collection, How to, How to, SMS, Text Messaging

Banks don’t have one type of loan. They have dozens.Equipment finance. Dealer floor plans. Auto loans. Commercial real estate. Working capital lines. Each portfolio has different borrowers, different terms, different risk profiles—and different communication needs.Yet...

Feb 9, 2026 | Debt Collection, SMS

Late payments cost equipment finance companies millions every year—not just in lost revenue, but in collection costs, strained customer relationships, and administrative overhead. Yet most lenders still rely on the same tired playbook: email reminders that go unread...