Compliant Texting for Businesses

Cloud Contact AI’s compliant two-way messaging platform enables you to create meaningful digital conversations across SMS, Email, and Voice without any code.

No credit card required

What you can do with CCAI

CCAI’s compliant-focused platform will help you connect with debtors on the platform that gets them to resolve outstanding debt the quickest, while ensuring that you’re complying with FDCPA guidelines.

Reminders and Support

Provide real-time support and resolve account delinquencies with SMS reminders.

Recruit Talent

Connect with job leads and send interview reminders for quick and easy on-boarding.

Maximize Sales

Leverage SMS to collect and nurture leads, helping you buy up debt faster than ever.

Outstanding Payments

Help your clients never miss a payment by sending them automated outstanding payment reminders so that they know exactly how much they owe and when they owe it.

Missed Payments

Follow up with your clients every time they miss a payment. Easily dispute debts with compliant two-way conversations in real time with our easy-to-use inbox.

Negotiate Settlements

Discuss payment plans, late fees, interest rates, and other useful information with your debtors to encourage more on-time payments.

Benefits of Compliant SMS

High Open Rates

Up to 98% open rates and 45% response rates

Cost-effective

Competitive rates of $.03 per SMS message

Time-saver

Reach thousands of debtors in seconds

Start reaching customer today

We make it fast, easy, and affordable to send compliant SMS, Email, and Voice campaigns.

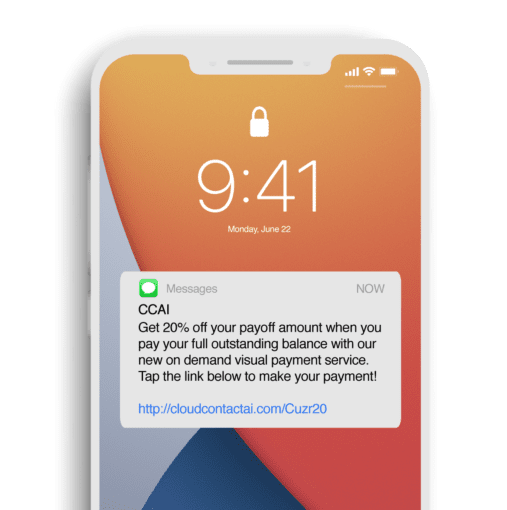

Features for Faster Collections

Close delinquent accounts and get paid faster with our powerful SMS marketing features designed to get you to your collection goals.

2-way real-time messaging

Encourage 2-way messaging to provide optimal, real-time support for your debtors. Offer them relief services directly to their smartphone.

Compliance Role

CCAI has a built in compliance role that enables you to invite your compliance officer to monitor and ensure campaigns are totally compliant.

Scheduled messages

Schedule send times that are FDCPA compliant for various use cases, such as general information or payment reminders.

Pre-built templates

Leverage our pre-built templates designed by our internal legal team that will provide you with quick and easy access to compliant messaging.

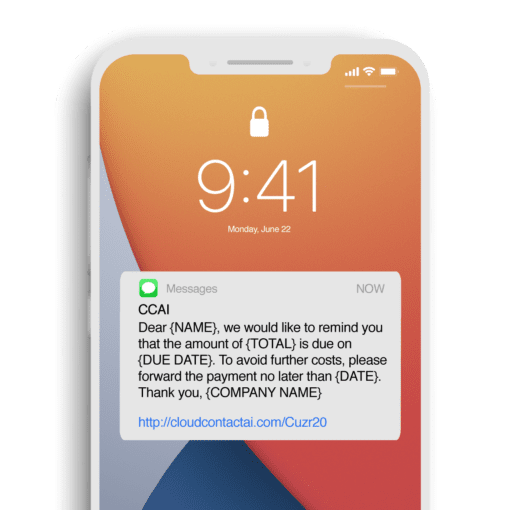

SMS Templates for Debt Collection

Improve results and get paid faster with our pre-built compliant SMS templates carefully crafted by our internal legal team to help you get a confident start. Copy, paste, and go!

Soft Automated Reminder

Dear {Name}, we would like to remind you that the amount {Amount Due} was due for payment on {Due Date}. To avoid further costs please forward the payment no later than {Max Due Date}.

Final Overdue Reminder

Dear {Name}, despite our previous reminders, we have still not received your payment. We regret to inform you that we have no other choice but to undertake legal action against you in order to retrieve the debt.

Strong Automated Reminder

Dear ${Name}, we have still not received the amount {Amount Due} that was due on {Due Date}. Should your payment be received within the next 7 days, we will not take court action. We urge you not to ignore this last reminder.

Thank You Message

Dear {Name}, your payment of {Amount Due} has been accepted and your debt has been cleared. If there is anything else that we can assist you with, please don’t hesitate to respond to this message for real-time support. Thank you!

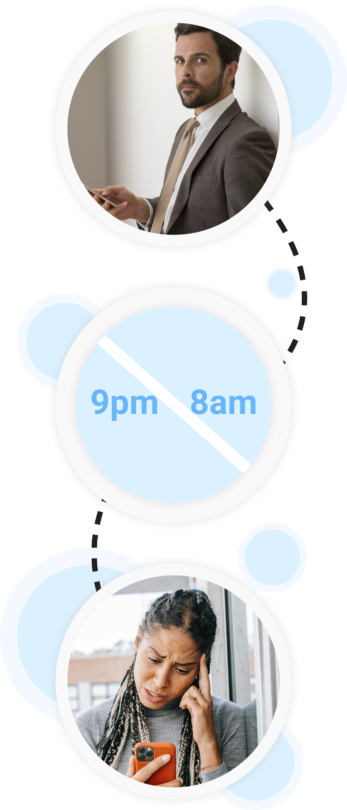

SMS Laws and FDCPA

In 1977, the FDCPA passed a law dictating the do’s and don’ts of collecting debt from consumers. The CFPB updated the policy in 2020 to accommodate for SMS messaging.

Check these “Do Nots” when sending debt collection text messages:

- Clients can only be texted between 8 am and 9 pm in their local time

- You can’t send consumers repeated messages

- You must reveal yourself as a debt collector when discussing with clients

- Client information cannot be revealed to a third party

This is not legal advice and should not be used as the basis of your SMS campaigns. You should consult the appropriate legal counsel before you begin sending text messages for collecting debt.

Frequently asked questions

SMS for debt collection comes with a lot of stress because of the strict compliance regulations. We are experts in compliance and can help guide your SMS journey.

How much does it cost to send an SMS for debt collectors?

On CCAI, it costs users $2 per phone number per month. Users have the ability to create unlimited numbers.

It costs users $.03 per outgoing and incoming SMS message. The cost to make a phone call on CCAI is $.02 per minute.

Users pay on a pay-as-you-go basis.

How often can I send texts for collections?

The last thing you want to do is annoy your customers. Some customers might get angry if you overload their inbox with messages; therefore, you should let your people know how often you intend to message them before sending them texts in regards to collections.

According to our experts, and from our own testing, we’ve found that you get the most engagement when you text your audience between 1-2 times per month.